In most communities, there are buildings that are currently unoccupied for a variety of reasons. We all can agree they’re bad for downtown, and if they sit vacant for too long, these properties can have serious negative effects, harming the district’s image, economy and overall activity. They can result in:

- Lost Revenue: Vacant buildings mean lost rental income and property tax revenue for the local government, reducing funds available for public services and infrastructure improvements;

- Reduced Business Activity: Empty storefronts and commercial spaces lead to decreased foot traffic, lower customer spending and reduced sales for neighboring businesses, impacting their profitability;

- Decreased Property Values: Vacant buildings drag down property values in the surrounding area, affecting property owners and potentially discouraging new investments.;

- Increased Maintenance Costs: Unattended vacant buildings deteriorate over time, leading to increased maintenance and safety costs for the property owners, adjacent property owners, and the locality, which further strains the local economy; and

- Negative Perception: The presence of abandoned or vacant buildings creates a negative perception of the downtown area, deterring potential investors, businesses, and visitors from considering it as a desirable destination.

A vibrant downtown relies on a mix of businesses, housing and cultural establishments to thrive, and vacant buildings greatly hinder this dynamic. Knowing this, as well as what’s mentioned above, advocates for downtown revitalization often struggle to effectively communicate the impact of vacant buildings to those with the power to enact positive change.

In 2019, Virginia Main Street (VMS) published The Cost of an Empty Building: Calculating Opportunities for Downtown on the VMS Blog to highlight what expert Donovan Rypkema of PlaceEconomics, a private sector real estate and economic development-consulting firm, had to say on the subject during a national Community Transformation Workshop hosted by Main Street America. He emphasized that calculating the impact of a vacant building is possible by simply analyzing the rent a building owner intends to charge. It can tell us many things, such as:

- How much can be invested in the building;

- The volume of sales needed to afford the space post-rehab;

- How much annual income a renter is making; and

- The catalytic impact of creating an upper-story housing unit for that renter

With that being said, you may be asking yourself, how do I do this and make reasonable generalizations about what opportunities are being missed by a building sitting vacant in my downtown? Rypkema encouraged using these basic formulas and figures derived from a Consumer Expenditure Index to do exactly that, and he provided an outline (see below) for how these calculations can be done successfully.

To start, calculate the rent to determine household income.

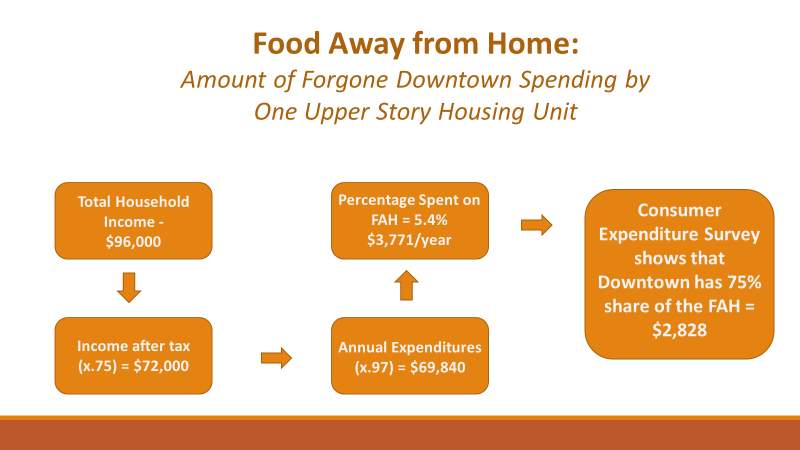

Household income can be used to calculate how much downtown spending could be captured if just one unit of upper-story housing was added above the vacant storefront.

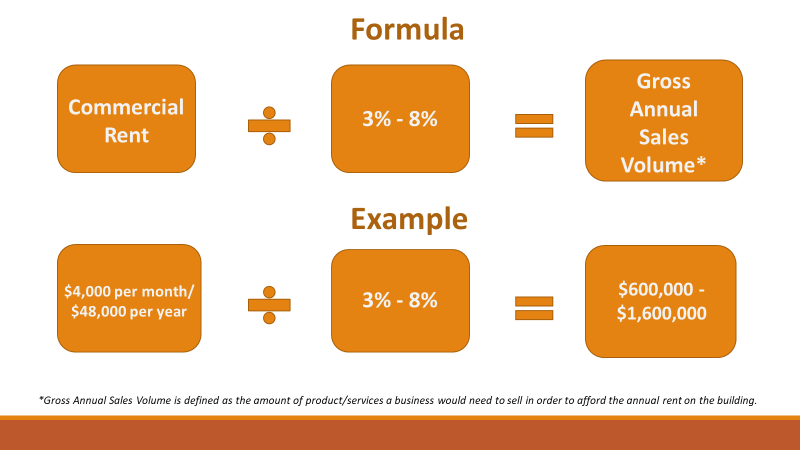

The commercial rent on a building can be used to calculate sales volume.

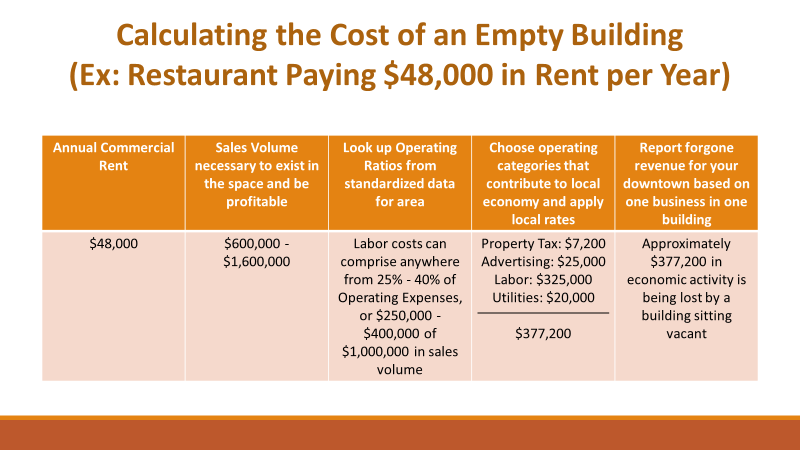

The sales volume can now be used to calculate the cost of a vacant building.

These figures will not be perfect, but they can help you advocate for development and better understand your vacant building stock downtown. While we all wish that our downtowns had no vacancies, they do pop up from time to time so consider this as one method to help you get them filled once again!

Image Credit: HoptownChronicle

Image Credit: Unsplash